HARd to Beat: The Overlooked Impact of Rolling Windows in the Era of Machine Learning

Francesco Audrino and Jonathan Chassot

COMPSTAT2024

August 30, 2024

Motivation

- Heteregeneous Autoregressive model is now over 15 years old.

- Well-established interpretable benchmark for realized volatility (RV) forecasting.

- Today, machine learning (ML) methods are at the center of nearly all modern research, seemingly surpassing HAR in many scenarios .

Has HAR's reign come to and end?

Our Contribution

- Demonstrate that seemingly minor modeling choices may drastically impact HAR's performance.

- Review previous works where ML outperforms HAR with and put these results into perspective.

- Study an unprecedented dataset of 1,455 U.S. stocks.

- Suggest ideal estimation approach for the HAR model.

Data

- High-frequency intraday data from Trades and Quotes (TAQ).

- 6,061 U.S. stocks the Center for Research in Security Prices (CRSP).

- ~9 years: January 1, 2015, to October 31, 2023.

- 1,455 stocks are consistently traded throughout the 9-year period.

- 27 / 30 of the Dow Jones Industrial Average (DJIA).

- 69 / 100 of the Nasdaq-100.

HAR Model

$$\mathrm{RV}_{i,t+1}^{(d)} = c + \beta^{(d)} \mathrm{RV}_{i,t}^{(d)} + \beta^{(w)}\mathrm{RV}_{i,t}^{(w)} + \beta^{(m)}\mathrm{RV}^{(m)}_{i,t} + \epsilon_{i,t+1},$$ where $\mathrm{RV}_{i,t}^{(d)}$ denotes the logarithm of the daily realized volatility of stock $i$ at time $t$ and

- $\mathrm{RV}_{i,t}^{(w)} = \frac{1}{5}\sum_{h=1}^5 \mathrm{RV}_{i,t-h+1}^{(d)}$

- $\mathrm{RV}_{i,t}^{(m)} = \frac{1}{22}\sum_{h=1}^{22} \mathrm{RV}_{i,t-h+1}^{(d)}$

HAR Model

$$\mathrm{RV}_{i,t+1}^{(d)} = c + \beta^{(d)} \mathrm{RV}_{i,t}^{(d)} + \beta^{(w)}\mathrm{RV}_{i,t}^{(w)} + \beta^{(m)}\mathrm{RV}^{(m)}_{i,t} + \epsilon_{i,t+1},$$ where $\mathrm{RV}_{i,t}^{(d)}$ denotes the logarithm of the daily realized volatility of stock $i$ at time $t$ and

- $\mathrm{RV}_{i,t}^{(w)} = \frac{1}{5}\sum_{h=1}^5 \mathrm{RV}_{i,t-h+1}^{(d)}$

- $\mathrm{RV}_{i,t}^{(m)} = \frac{1}{22}\sum_{h=1}^{22} \mathrm{RV}_{i,t-h+1}^{(d)}$

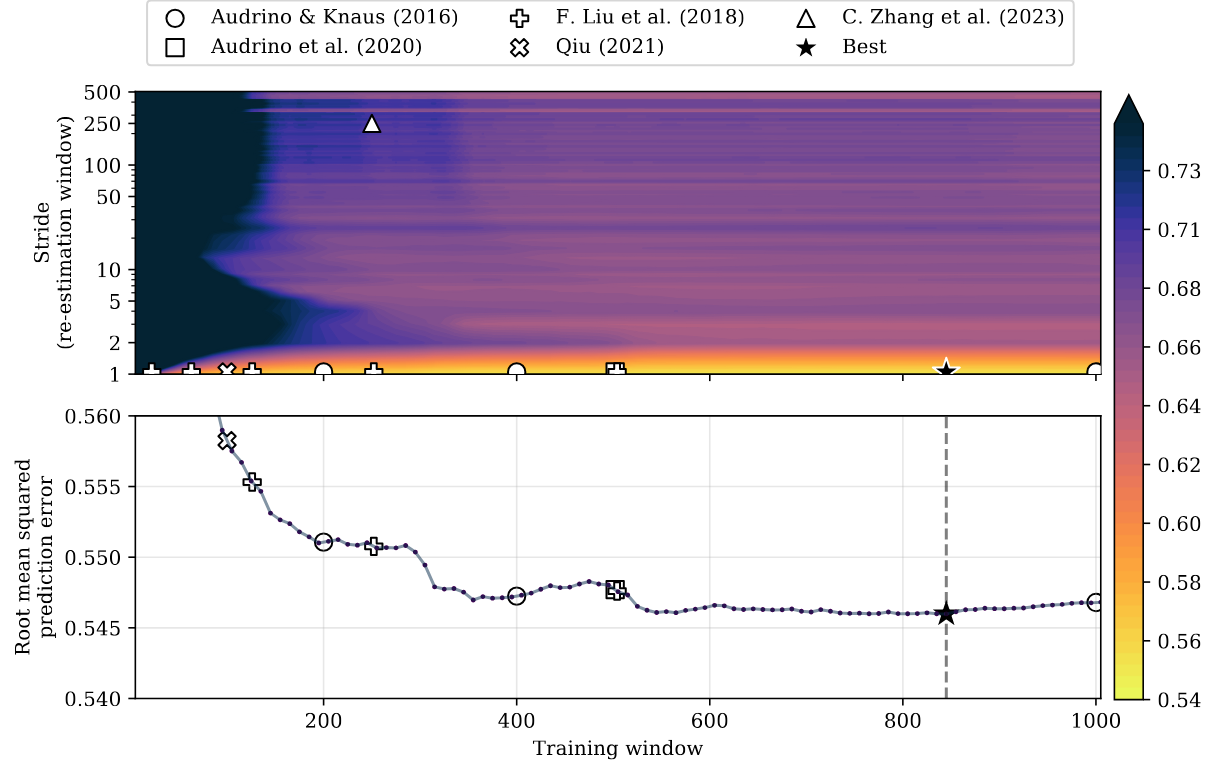

Estimating the Coefficients

Typically, HAR is estimated in a

- how often to re-fit the model (

stride orre-estimation frequency/window ) - on how much data to fit the model (

training window ) - whether to

roll orexpand the training data

Current Studies

| Study | Window Style | Training Window | Stride | Assets |

|---|---|---|---|---|

| rolling | 200, 400, 1000, 2000 | 1 | 9 | |

| rolling | 502 | 1 | 19 | |

| rolling | — | — | 29 | |

| rolling | 22, 63, 126, 252, 504 | 1 | 4 | |

| rolling | 100 | 1 | 1 | |

| expanding | 250 | 250 | 100 |

Models

HAR model

- Estimate via OLS and WLS

- Estimate individually and in a pooled manner

ML models

- Lasso

- Random Forest

- Gradient Boosted Trees

- Feedforward Neural Networks

Comparison

- Mean Squared Error (MSE), QLIKE , and Realized Utility .

- Each model is estimated once using only past RVs and once with the addition of the VIX (16 models).

- Compare distributions of the losses.

- For every asset, compute the model confidence set with a 95% level of confidence.

- Repeat the comparison for the DJIA and Nasdaq-100 universes only.

Conclusion

- A properly fitted HAR model still reigns supreme for RV forecasting.

- Use a properly fitted HAR model as benchmark when comparing your novel method…

- estimate in a

rolling manner, - re-estimate

daily , - use between

2.5 and 4 years of training data - estimate via

weighted least squares ,